As the Yes! Yes! Lender, Westlake Financial aims to say yes to anything a dealership might need. Westlake strives to provide independent and franchise dealers with the level of support, technology and financing flexibility to succeed. Offering a full spectrum of competitive financing options, Westlake helps you, the dealer, accommodate a multitude of customers.

Receive 100% automated credit decisions and lightning fast approvals 24/7/365 from DealerCenter®, Dealertrack®, Route One®, and CUDL ®. You control the financing with Westlake’s deal enhancement tools, AutoStructure™, and IMAXX™. You can also receive funds faster by eContracting any deal from any system.

Finance any customer that walks in the door! We offer a full array of tailored finance programs for customers of every credit score. Dealers will have the ability to offer rates as low as 7.49%, terms up to 72 months, and down payments as low as $0. Dealers also benefit from Westlake’s Finance Programs as they can receive up to 2% dealer participation for certain credit tiers and dealer fees as low as $0. Westlake offers Titanium, Platinum, Gold and Standard programs for customers of any credit score! With the largest dealer network in the US, Westlake is in the business of helping both independent and franchise dealers increase their bottom line.

Offer rates as low as 6.99% with up to 2% dealer participation with Westlake’s Titanium program. Not to mention dealer fees and down payments which can be as low as $0 and terms that go as high as 72 months. Provide aggressive financing options to prime customers who walk onto the dealership lot. Needless to say, the Titanium program allows Westlake to be a truly competitive full-spectrum lender.

Highlights:

Get low dealer fees and cater to a wider range of customers of good credit buying used or tough-to-finance vehicles. There is no vehicle mileage restriction, and loan terms up to 72 months with minimal STIP requirements. The Platinum Program allows Westlake Financial to be competitive with other banks for prime and near-prime credit customers.

Highlights:

Provide aggressive financing options to customers with established credit history, regardless of vehicle mileage or age. The Gold Program offers loan terms up to 72 months, competitive rates, and low dealer fees. Similarly to customers that are in the Standard Program, customers with hard-to-prove incomes, open or discharged bankruptcies, and prior non-Westlake repossessions all qualify for the Gold Program.

Highlights:

Don’t turn away those hard-to-approve customers! Dealers can approve first-time and sub-prime buyers with Westlake Financial. With the Standard Program, dealers can enjoy lender fees as low as $349. Dealers rely on this program as the backbone to their sub-prime finance business.

Highlights:

Westlake offers financing on specialty vehicles. We offer flexible terms and low interest rates for qualified buyers so you can offer the best deals on any kind of vehicle to your customers.

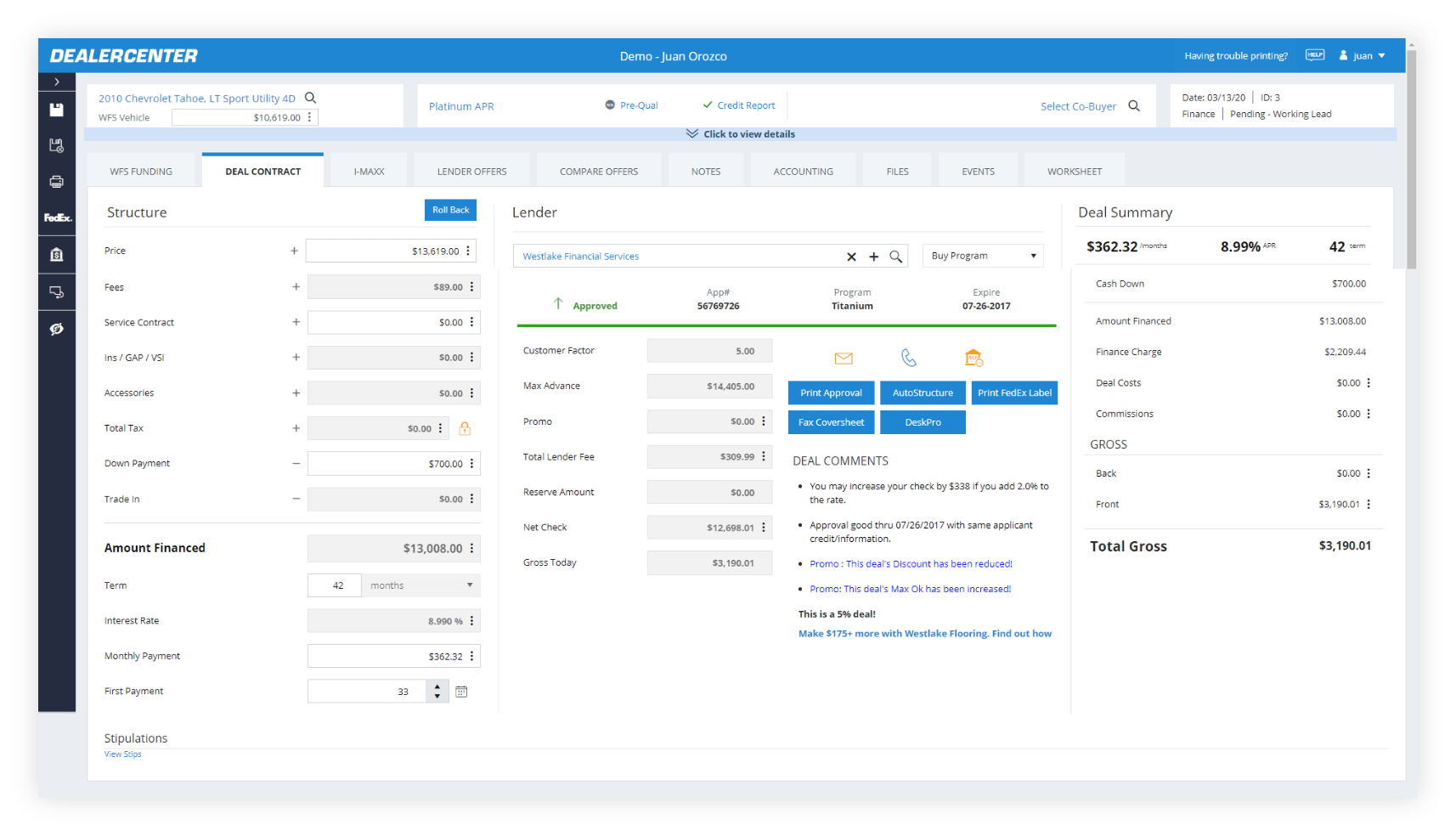

Take control of your retail finance deals! In seconds you can lower your deal discount by adjusting term, down payment, and sales price. Westlake allows you to rehash your deal to making negotiating easy. You’re your own credit analyst.

AUTO-STRUCTURE

Instantly calculate the best deal structure with the highest net check using the customer’s desired monthly payment & down payment.

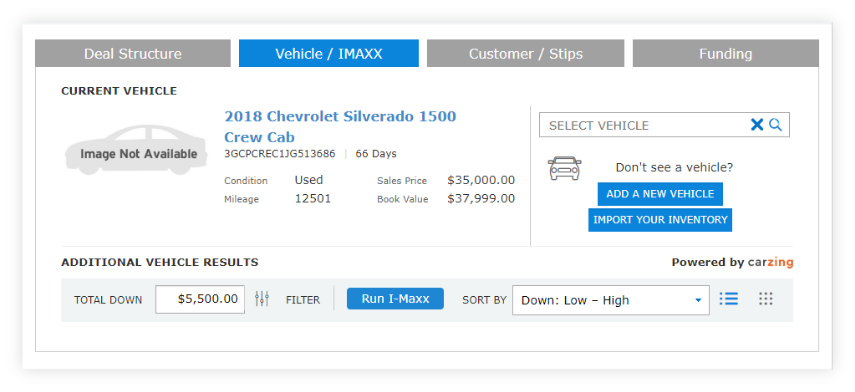

I-MAXX

Using desired down payment and monthly payment, Westlake’s I-Maxx tool can quickly find all the vehicles in your inventory on which a customer is approved.

Rehash and Control Your Financing!

AUTO-STRUCTURE

Instantly calculate the best deal structure with the highest net check using the customer’s desired monthly payment & down payment.

I-MAXX

Using desired down payment and monthly payment, Westlake’s I-Maxx tool can quickly find all the vehicles in your inventory on which a customer is approved.

Rehash and Control Your Financing!

Credit decisions are now in your hands. Maximize your net checks and showcase an ideal structure for your customers’ needs with Auto-Structure. This tool allows dealers to input the customers desired monthly payment and down payment to adjust the deal structure. Westlake gives you the control to find the right structure. Check out the images to see how this program works.

Don’t let customers walk off the lot without an approval. Using a preferred down payment amount and monthly payment amount, Westlake’s I-Maxx tool can quickly find all the vehicles in your existing inventory in which a customer can be approved. I-Maxx helps dealers provide a menu of vehicles and loan structures for their customers to minimize the loss of sales due to inadequate finance options.

Speed up your funding time and shift away from the error-prone approach of manual entry. Dealers who eContract with Westlake often see funds a full day faster once the deal package is complete. With eContracting, dealers can also ensure they have captured the proper signatures, forms, and deal documents. Westlake accepts eContracts on all deals regardless of credit type through Route One® and DealerCenter®. Dealers who submit applications through Dealertrack® can use DealerCenter® eContracting simply by rehashing the deal.